The Status divide: How motivations for travel vary across APAC Markets

MMGY’s latest report into Asia Pacific International Travelers examined the habits, preferences and motivations of international leisure travellers from China, India, Japan, South Korea and Australia. Surveying 800 respondents from each nation, this study provides an in-depth look into the divergent habits of this audience and highlights the most effective ways travel service providers and marketing campaigns can target travellers in these highly distinct regions.

Two Mindsets, Two Very Different Trips

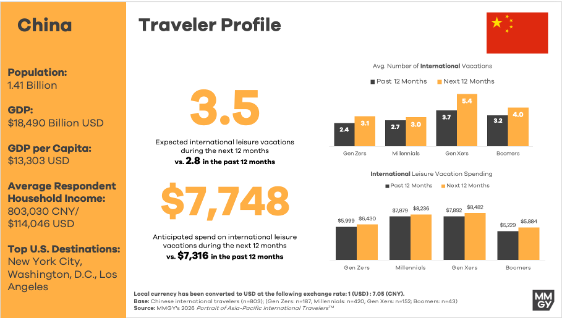

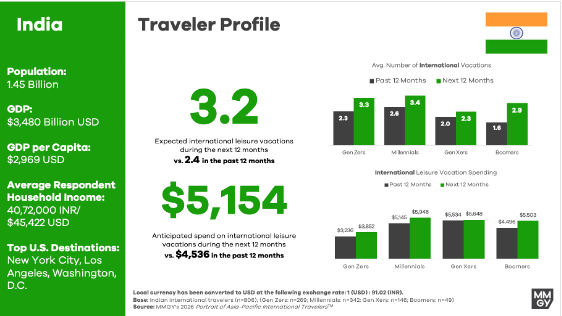

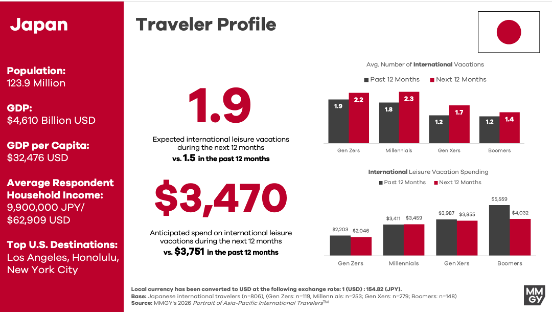

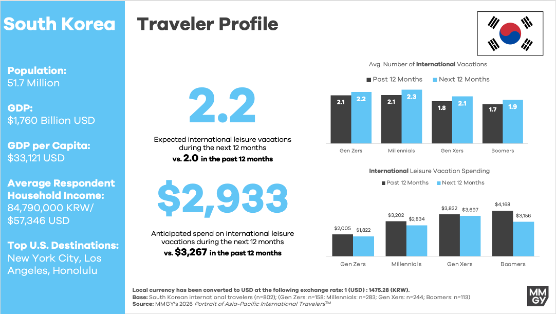

Australian, Chinese and Indian travellers plan to spend significantly more on their international vacations over the next 12 months in comparison to those from Japan and South Korea, (~$7,000 compared to ~$3,000).

Status and the perception of others often play a significantly larger role in the travel plans of Chinese and Indian travellers, as international vacations are seen as key to showing off their social status.

Trips are frequently planned around “Instagrammable” destinations, and they have a penchant for bringing home luxury goods to display proudly.

Alternatively, Japanese and South Korean travellers' decisions tended to by driven by a price-conscious outlook, prioritizing the cost of airfare or hotel rooms over superior service, convenience or quality.

These travellers prefer allocating a larger proportion of their budgets to experiences whilst on vacation, instead of the status symbols their Asian counterparts seek.

Status-Driven: China and India

Building on this comparison in more detail, we can see how these two mindsets manifest across various travel habits. Status-Driven Travellers (Chinese and Indians) contrast to Experience-Driven Travellers (South Korea and Japan) through their choice of hotels when on vacation. The price-conscious experiential travellers prefer to stay in budget or mid-range lodgings, while luxury hotels are far more popular among the status-driven. For example, 17% of Chinese travellers stayed in a boutique hotel over the past 12 months, compared to just 3% and 4% of Japanese and South Korean travellers respectively.

A preference for all-inclusive resorts and luxury hotels reflects a broader trend of showing off big brand names. These travellers enjoy the image that comes with big spending on all aspects of their vacations, ranging from flying in first-class to staying in top-tier hotels. Embedded cultural values are a key influence on their vacation choices, with a focus on status and “face” (social reputation and how one is perceived by others) permeating all aspects of Chinese culture, particularly among older generations. A similar emphasis on status and perception permeates through Indian culture too, driven by social hierarchies and class dynamics. This phenomenon has been complimented by the growing middle class in both countries, where more travellers are enjoying the benefits of higher-paying jobs and significant increases in disposable income.

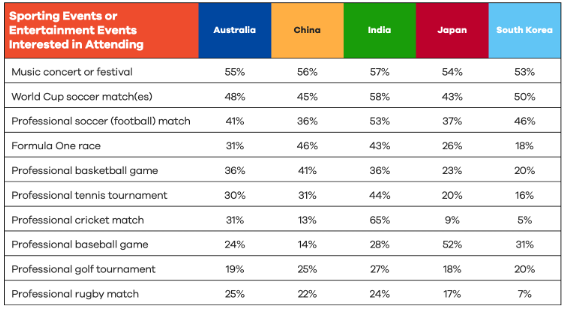

On the other hand, the ability to command respect in Indian and Chinese societies is driven to a large degree by perceived class, which in turn, is exemplified through material possessions such as luxury travel souvenirs or lavish holidays to exclusive destinations like the Swiss Alps or luxury resorts in Bali. Furthermore, activities of interest on international vacations reflected this mindset, with adventure travel and attending live sporting or entertainment events emerging as significantly more popular among status-driven travellers. This contrasted to experience-based travellers who preferred more affordable experiences such as visiting historical sites or museums.

Marketing Implications

Curating exclusive luxury packages that emphasize exclusivity and prestige would hold fantastic appeal among this status-driven audience. This study found that global events such as the 2026 FIFA World Cup were a highly popular event to attend, especially for Indian travellers, and exclusive packages geared around attending this, and other, prestigious events would resonate excellently.

Secondly, showcasing highly “Instagrammable” destinations can serve as a powerful motivation for status-driven travellers. Curated tours that guarantee exclusive photo angles or access to visually iconic spots can significantly influence trip-planning decisions. Enhancing this further with optional add-ons, such as a professional photography service to capture the moment in high definition, would allow travellers to capture high-quality content geared towards social media posts. This not only creates lasting memories of their travel experience but amplifies the social and cultural benefits when travellers share their vacation pictures with friends and family.

Experience-Driven: Japan and South Korea

Japanese and South Korean culture places significant emphasis on harmony and respect, emphasising restraint and the appreciation of fleeting experiences. With a preference for authentic moments and connections with loved ones, luxury holidays and possessions are not seen as methods for signifying status or class in the way they do in India or China. Furthermore, while appearance and presentation are certainly very important in South Korea due to high beauty standards, this tends to be expressed through fashion and technology as opposed to luxury vacations. As a result, travel habits for many are far more restrained, with Experience-Driven Travellers expecting to take 1.9 to 2.2 vacations with a combined budget ranging from $2,900 to $3,500 over the next 12 months. This lower spending also indicates that they are significantly more likely to visit nearby international countries, avoiding expensive, inter-continental vacations.

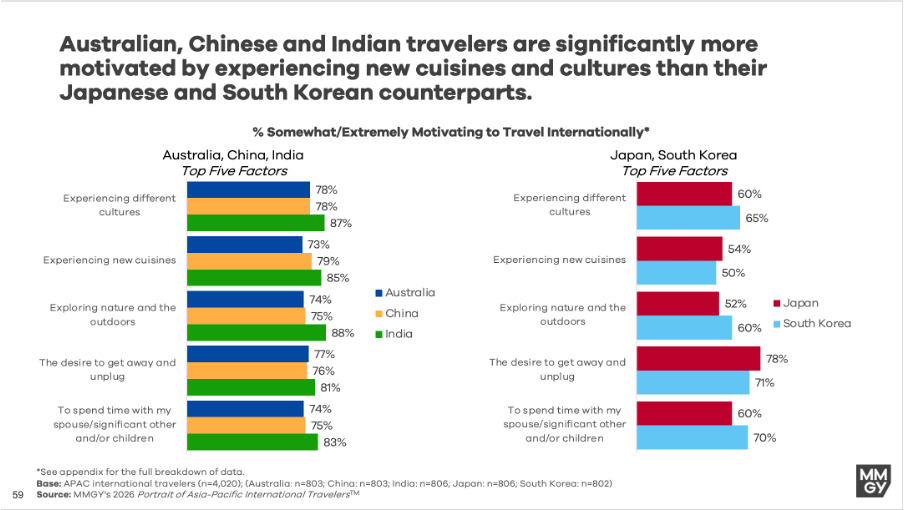

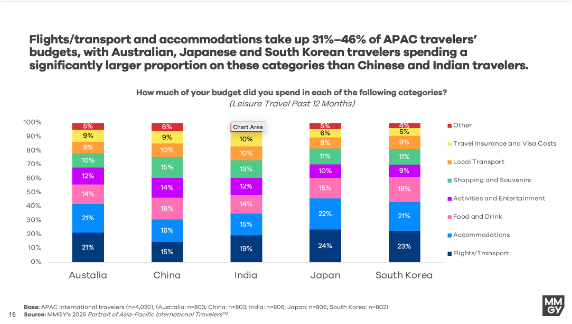

Furthermore, the Japanese economy has faced high levels of stagnation and deflation since the 1990s, leading to a high cost of living and culture of cautious spending which contrasts with the rapid economic development of China and India. Among Japanese and South Korean travellers, more than 44% of the total travel budget goes toward accommodation and flights or transport, substantially higher than the 34% maximum seen among Chinese and Indian travellers. This indicates a stronger focus on essential trip costs rather than discretionary in‑destination spending such as luxury shopping or souvenirs. Japanese travellers are significantly less likely to book/plan travel on their mobile phones, indicating a lower likelihood for impulsive decisions following appealing adverts or social media posts. Japanese travellers also place significantly more emphasis on vacations as a break from their regular lives, with 78% citing the desire to get away and unplug as highly motivating to travel, more than any other reason. Relaxing, cultural getaways which include a city break and visits to historical sites or museums are among Japanese travellers’ top destinations and activities.

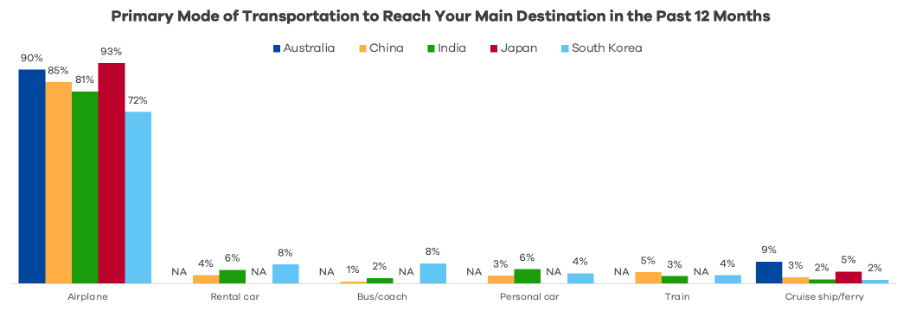

South Koreans have faced similar economic pressures over the past decades, with a competitive economy and high cost-of-living expenses for housing, education and more, resulting in savings prioritised over expensive travel experiences. One way that their frugal travel habits can be seen is by their preferred mode of transportation when travelling abroad, 28% of trips were taken by rental car, bus/coach, personal car, train or cruise ship/ferry, significantly more than any other nation, where airplane travel is overwhelmingly dominant. Choosing alternative travel methods is an easy way to drive down trip costs and indicates that many South Koreans are traveling to nearby countries instead of taking long-haul flights.

Marketing Implications

Overall, the best ways to attract South Korean and Japanese travellers would involve highlighting competitive airfare and hotel rates – bundling economy flights with midrange hotels that have a strong reputation for cleanliness and safety would be highly popular. Secondly, promoting cultural, historical and culinary activities in cities is likely to be a highly successful strategy, especially when these travellers are targeted through popular social media platforms. YouTube and Instagram are essential in Japan and Naver in South Korea, and including localised content, promotions and professional destination photos are all likely to play well with this audience.

To conclude, the APAC region is not a monolith, and this blog has attempted to illustrate how the ingrained cultural and social differences between some of the countries surveyed in MMGY’s recent study impact travel planning and preferences. Being able to select the right vacation package, accommodation or experience to highlight to each of these countries is essential for building a presence in these markets, and MMGY’s report helps to understand traveller preferences through primary survey data, coupled with expert analysis from an experienced team of analysts.

Australians plan to spend $7,124 on international leisure travel in the next 12 months — one of the highest figures in APAC, and far above Japan and South Korea.

41% of Australians who stayed in a hotel in the past 12 months chose a luxury hotel — significantly higher than Japan (31%) or South Korea (36%), and closer to Chinese and Indian luxury behaviour.

Australians also show usage of all‑inclusive resorts (17%) and boutique hotels (9%), signalling uptake of higher‑end accommodation categories.

Australians allocate a large share of their trip budget to flights (21%) and accommodations (21%), a hallmark of premium‑oriented travellers who prioritise comfort & quality.

The proportion of their trip budget on activities and entertainment (12%) is also higher than Japanese and South Korean travellers (9-10%) and closer to the (12-14% of Indian and Chinese travellers)

Nearly 43% of all Australian international flights are booked in premium cabins (premium economy 18.5% + business 14.7% + first class 9.8%).